Figure of the month: 1521

News Arnulf Hinkel, Financial Journalist – 12.12.2022

Around 2300 years before the classical gold standard facilitated the creation of a stable global monetary order in the late 19th century, the Lydian king Croesus had already introduced the first hard currency in the form of standardised gold coins. They served equally as a means of payment and store of value. To this day, gold is deemed a safe haven and reliable protection against inflation. In one exceptional case in history, however, gold and silver coins fuelled a major inflation: the so-called price revolution lasted from the end of the 16th into the 17th century.

Around 2300 years before the classical gold standard facilitated the creation of a stable global monetary order in the late 19th century, the Lydian king Croesus had already introduced the first hard currency in the form of standardised gold coins. They served equally as a means of payment and store of value. To this day, gold is deemed a safe haven and reliable protection against inflation. In one exceptional case in history, however, gold and silver coins fuelled a major inflation: the so-called price revolution lasted from the end of the 16th into the 17th century.

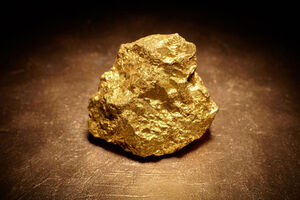

Grand-scale exploitation of the New World from 1521

In the century after Columbus discovered America, many Spanish conquistadores were driven to the New World – always in search of “El Dorado,” The Golden One. Dreaming of great cultures where gold and silver existed in abundance, they literally struck gold. Starting with the Incas, they discovered numerous tribes of indigenous people who actually had access to precious metals in hitherto unimaginable quantities. Mercilessly, the Spanish Knights of Fortune began to force the indigenous peoples into large-scale mining of gold and silver, which, due to the massive use of mercury, had terrible health consequences for the enslaved.

Inflation rates of 350 per cent in Europe

The precious metal thus extracted was minted into bars or coins on site and then shipped to Spain, whence the gold and silver coins were dispersed throughout Europe – with unimagined consequences. While the coins in circulation had suddenly multiplied, they were not matched by an equally increased supply of goods. The ensuing massive rise in prices led to the first major inflation in Europe, an entirely unique process in human history.