- Study shows factors influencing investment behavior

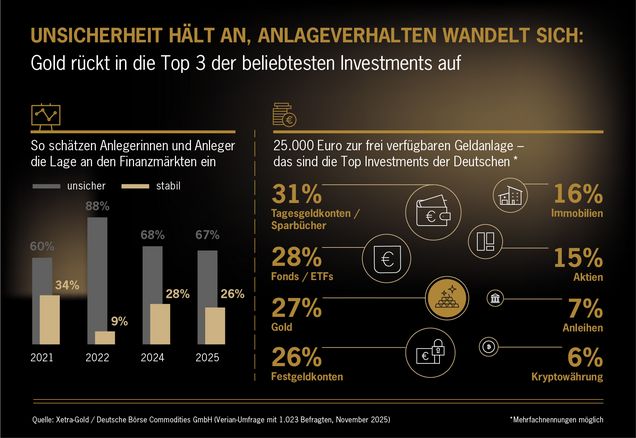

- Majority considers the situation on the financial markets to be uncertain

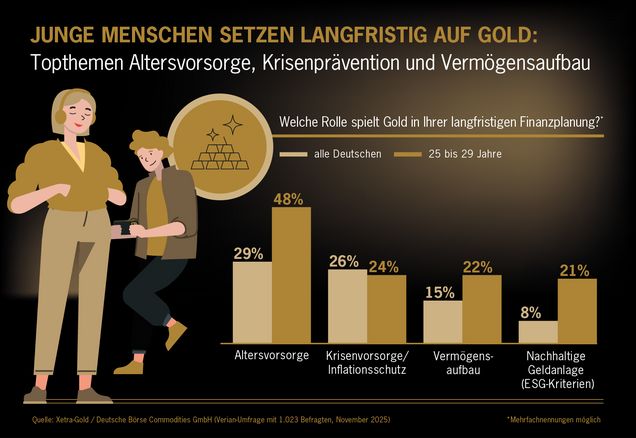

- People aged 25 to 34 rely on gold

Military conflicts, US customs policy, and the hype surrounding artificial intel-ligence (AI) are causing concern among Germans. Two-thirds (67 percent) feel insecure in the current environment and are concerned about their assets.

At the same time, confidence in gold is growing, particularly among the younger generation. According to the representative study 'Investment Barometer 2025'* by Deutsche Börse Commodities GmbH, gold is the most popular asset class among 25- to 34-year-olds. Currently, more than half of this age group (53 percent) can imagine investing in gold. Overall, many Germans see the pre-cious metal as a valuable addition to their long-term investments, including re-tirement provision (29 percent), protection against crises and inflation (26 per-cent), and asset accumulation (15 percent).

Just under a third (31 percent) of Germans are not at all worried about their as-sets. Accordingly, safe and stable investments are becoming increasingly im-portant: For the first time since 2022, gold has re-entered the top three most popular investments. More than one in four people (27 percent) would invest €25,000 in gold, which is almost as popular as savings accounts (31 percent) and funds/ETFs (28 percent), and more popular than traditional fixed-term de-posits (26 percent). Meanwhile, real estate (16 percent) and stocks (15 percent) are losing relevance, and bonds (7 percent) and cryptocurrencies (6 percent) play only a minor role. When asked about the most trustworthy investment, savings accounts are in the lead with 21 percent, followed by gold and funds/ETFs with 14 percent each.

Among 25- to 34-year-olds, gold is the most popular investment. More than a third (35 percent) would choose it with an initial investment of 25,000 euros. Gold also ranks first for them in terms of trust (18 percent), ahead of savings accounts (14 percent), fixed-term deposit accounts, and real estate or funds/ETFs (both 13 percent). When it comes to long-term investments, the younger generation is leading the way. Almost half of people between 25 and 29 (48 percent) consider gold to be relevant for retirement provision, which is sig-nificantly higher than the overall average (29 percent). Furthermore, one in five (21 percent) cite sustainability/ESG criteria as a reason for investing in gold in the long term, compared to only 8 percent of all respondents.

Stability and security in the investment portfolio

“The investment barometer shows that a consistent majority of Germans per-ceive the situation on the financial markets as uncertain,” says Steffen Orben, Managing Director of Deutsche Börse Commodities GmbH. “At the same time, the representative sentiment indicates a growing shift towards gold, which has increased in value by over 50 percent so far in 2025.' Young people in particular are increasingly relying on gold as it is one of the most stable asset classes, with a positive price development over the years. Experts recommend includ-ing five to ten percent of gold in a portfolio to secure assets.”

Currently, almost half (45 percent) of Germans can imagine investing in gold. For medium- to long-term investors, bearer bonds such as Xetra-Gold® provide an easy alternative to a physical purchase. Xetra-Gold is a cost-efficient secu-rity that enables tax-free profits with a holding period of more than one year. Each security is backed by physical gold at a ratio of 1:1 and can be redeemed if necessary.

* About the Investment Barometer 2025 study: On behalf of Deutsche Börse Commodities GmbH, the opinion research institute Verian (formerly Kantar Public) surveyed a representative sample of 1,023 people in Germany. The sur-vey was conducted in the period from November 20 to 28, 2025.