Trading Xetra-Gold

Xetra-Gold® is a security that can be traded just as easily as a share – directly on the stock exchange. It tracks the gold on a virtually 1:1 basis and thus enables investors to participate directly in the performance of the gold price. The combination of low-cost stock exchange trading and the option of physical delivery makes Xetra-Gold a particularly flexible and attractive way to invest in gold.

Cost-effective and transparent trading

Xetra-Gold® is a highly efficient and simple way to participate in the gold market. It is cost-effective and eliminates currency risks, as it is quoted in euros per gram unlike the usual quotation of gold in US dollars per ounce.

For the purchase or sale of Xetra-Gold, no mark-up or management fees are payable, as is usually the case with physically backed gold securities. Only the standard transaction fees charged for on-exchange trading apply. A low spread of 0.1 percent on average (max. 1 percent) in Xetra® trading guarantees low trading costs.

Trading and exercising

Continuous trading on Xetra

Investors can buy and sell Xetra-Gold® (ISIN DE000A0S9GB0) on trading days between 9:00 and 17:30 CET through the Xetra® trading venue: liquid, continuous trading with high transparency on the regulated market of Frankfurter Wertpapierbörse (FWB®, the Frankfurt Stock Exchange).

Deutsche Bank is among the Designated Sponsors which ensure that buy and sell orders within the current bid-ask spread and up to €100,000 are executed immediately. In all market situations, the bid-ask spread of Xetra-Gold may reach a maximum of 1 percent, significantly below that of other gold-based financial products.

Delivery of gold

If an investor asserts the right to the delivery of the certificated amount of gold from the issuer, the gold is transported to the respective point of delivery by Umicore AG & Co. KG, which is responsible for all physical delivery processes. Furthermore, the issuer holds a limited amount of gold in delivery claims with Umicore.

Information on delivery and the alternative payment claims relevant for investment and insurance companies are available for download below in the document 'Information on the process for exercising Xetra-Gold'.

Delivery costs depend on the quantity and delivery location.

Download: Information on the process for exercising Xetra-Gold

Fees

When trading Xetra-Gold®, the standard transaction fees that are charged for on-exchange securities trading apply. In the relationship between Clearstream Europe AG, the custodian, and the respective custodian bank of the investor, custody fees are charged per calendar month which, until further notice, amount to 0.025 percent of the monthly Xetra-Gold holdings, totaling 0.3 percent annually plus VAT. The end customer only pays the amount of custody fees agreed with the depository bank. Investors requesting repayment of Xetra-Gold in euros will receive a repayment amount corresponding to the relevant gold market price, less a settlement fee of €0.02 per bearer bond.

Gold holdings

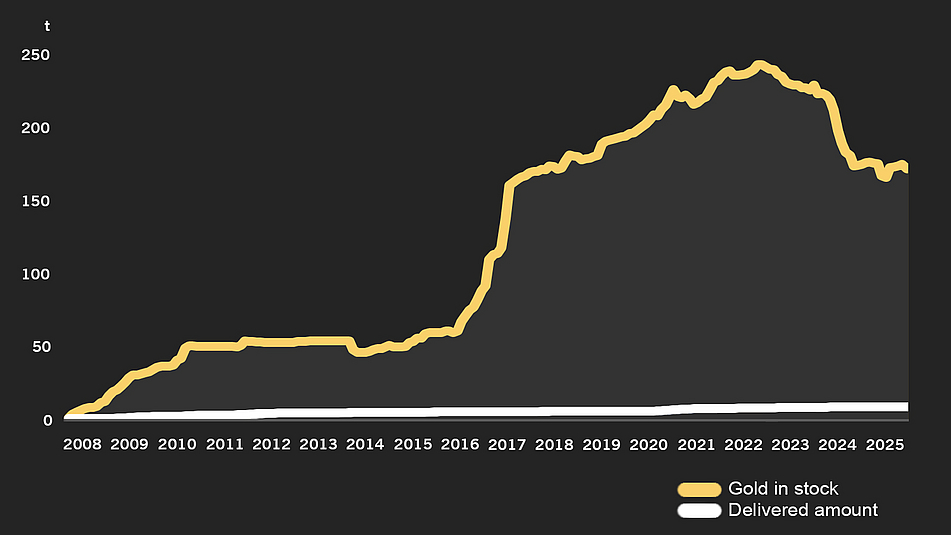

Holdings include roughly 180 tonnes of gold

The holdings of Xetra-Gold amount to about 180 tonnes of gold. At the same time, the number of deliveries of physical gold has risen to more than 2,000, at a total volume of over 8 tonnes.

Zur Zeit liegt der Bestand von Xetra-Gold bei rund 180 Tonnen Gold. Gleichzeitig beläuft sich die Zahl der Ausübungen des physischen Goldes seit 2007 auf mehr als 2.000 Auslieferungen, mit einem Gesamtvolumen von mehr als 8 Tonnen.

| Issued units (kg) | Physical holding (kg) | Gold delivery claims (kg) |

|---|---|---|

| 171,850 | 168,221 | 3,628 |

As of 12 February 2026

Source: Deutsche Börse Commodities

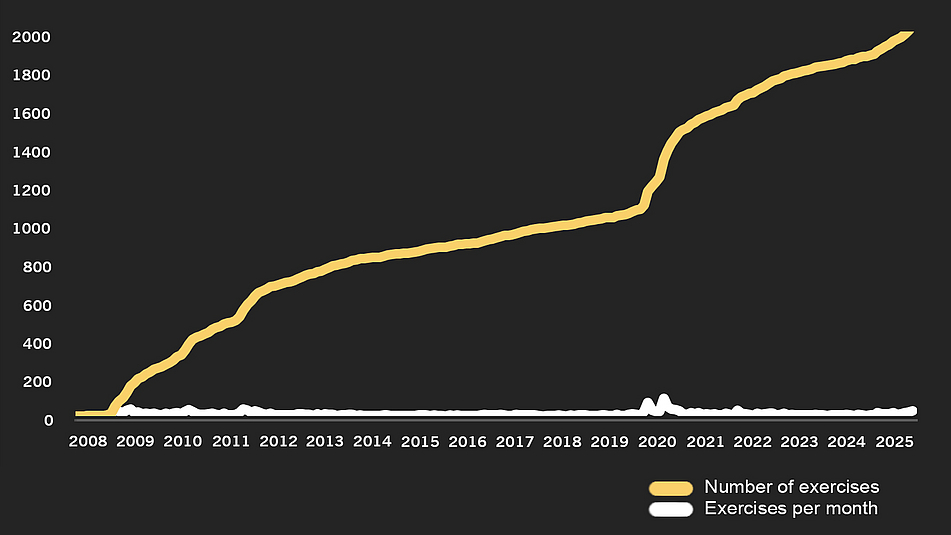

Exercices

| in January 2026 | Total |

|---|---|

| 18 | 2,053 |

As of: 31 January 2026

Source: Deutsche Börse Commodities

Gold bars under custody by Clearstream Europe (as of 5 February 2026)